The cotton market in the first half of 2018 or the external weak internal strong situation

Author:GK Date:2017-11-06 From:GK Hits:975

The cotton market in the first half of 2018 or the external weak internal strong situation

This year, starting from September, we have entered the new cotton season. As everyone knows, the price of zheng cotton futures has been relatively low recently. What is the situation?I'd like to focus on today may want to share with you the new annual cotton of the overall market conditions, and the cause of the current market conditions, as well as the future for a period of time an impact analysis of the market.

I. basic information and general trend of supply and demand in New Year

Since September, the domestic cotton market has faced so many prominent contradictions.

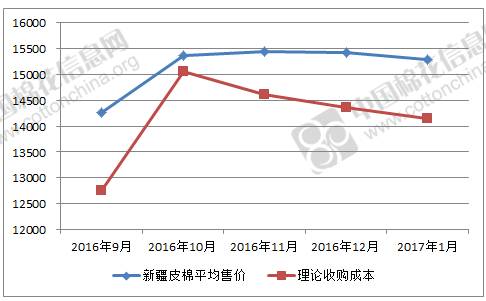

This is our last year's statistics.The annual October is a season of cotton harvesting, so prices tend to be high, and the harvest price of the seed cotton is relatively high.

Red is the acquisition cost, the blue is the price of the cotton price, you can see that there is still a price difference, that is, last year no matter do spot, do the futures are the relatively big profit.What happened this year?

This year, in fact, the price is higher, I can give you a look at the specific number, the price still remains essentially, like a slight decline in kashgar region, this is all points area, the data is completely cotton farmers open land tax invoice price, the price is very real.

There is a very important change here, which is that this year's cotton seed price has fallen sharply. In 2016, the price of cottonseed was two six seven, but this year it has fallen to one six.What does one dollar of cotton seed price mean?Means lint acquisition costs more than 1000 dollars, that is to say the same seed cotton purchase price, the lint cost is sharply rising, because the price of cotton seed fell, cottonseed low profits, so the corresponding cost of lint, it is high.

May also see a hand pick up cotton picking cotton and machine, as we all know more than 60% of is a hand to pick cotton in xinjiang, pick up cotton is 40% machine pick up cotton machine is, the machine picked machine-packed cotton must be relatively good, and is popular with the market, pick up cotton machine prices remained in six pieces of a thing or two, seven pieces of 3, 7 block 2 are hand picked cotton, they offer basically sent 1 yuan per kilogram, what does it mean?That means the cost of his cotton wool is less than 1,000 yuan.

That is to say, the cost of picking cotton this year is very high, which is very inappropriate to continue to do stock.This year there are a lot of futures, a subsidiary of spot subsidiary company of the futures economy also in cotton, also doing the warehouse receipt, but the prices obviously pick up cotton is machine cost is relatively speaking, do the warehouse receipt and possibilities, but hand picking cotton possibility is very low.

What's the paradox?In 2017 was still relatively quickly, because this year on XinJiangMian whole processing of absolute higher than last year, 500000 tons, but southern xinjiang mainly produce hand picking cotton rather later than usual, why late?There is a problem of picking and policy reasons. What is the result of the mismatch between the two?

Is now in the market to be able to pin out basic it is pick up cotton machine of the crop, quality is better, the consistency is good, the price is lower, so the price is according to the machine pick cotton prices, and hand picked cotton because listed slow, cause pricing does not account for the initiative, this is about the future of cotton futures pricing will play a critical role.

And another one is now zheng cotton futures with the quality of the gap between the current domestic spot or bigger, this is a liter discount, the quality I didn't get discount to speak, because XinJiangMian mostly premium, so take out some premium can see out.

China cotton co., co., is a premium of the stock, which is a premium for the futures warehouse.I found a casually, zhengzhou 2130 a, plus the value of the premium, it is 1000 yuan, more than it is now more disk price 1000 yuan, but only 750, according to the calculation of cotton association decided between them?The pricing of futures warehouse receipt must be one of the few cotton, that is, we think that 10% - 15% of the cotton price, can also explain listed in such a stage, the main why nan Yang and such a low price.If it's 2130 cotton, it's actually going to be 16,000, and that's not particularly big, so it's going to explain something.

What would be the result?

Once there is a chance, there will be a lot of cotton that fits this high water to cover it, which is an important reason why the pressure of the plate won't come.

Another is the current price impact, you can look at the freight of the territory cotton, this is related to zheng shang's rules for this year's delivery.What's the price of transportation now?

This is our tracking the price of highway transport, from aksu, kuytun hair now in henan was lower prices higher than last year, for the fourth quarter of last year goods rose, the capacity of xinjiang is very tight, highway freight prices sharply higher, lower than last year, this year, but still remain at around 800 levels.The shipment to shaoxing is more than 800, and the shipment to nantong is more than 800.

So if 1000 minus 1000, or 200 dollars of premium, so from the current, the premium is low, the future for a period of time may be faced with a lot of enterprises in xinjiang is now under the condition of the discount price is so, there was no way to delivery in xinjiang, it is no way to do the warehouse receipt, a large number of inland transport, there will be a period of time, into the future of the warehouse receipt constantly rising, may have the opportunity of the warehouse receipt, the price of that this opportunity must be to disk to cooperate, the current disk price useless this opportunity.

Ii. Influencing factors of new annual market trends (analysis of variables)

Why would that be the whole story?First of all, we have a perceptual understanding. At present, cotton is the focus of the market. What is the situation after that?We want to see a balance sheet, global balance sheet, the U.S. department of agriculture of global production and sales forecast, basically is a production and marketing of the gap is 3 million tons this year, it is 2017/2018 years of data, but in China, 3 million tons of gap, under the premise of global or to produce more than 700000 tons, that if threw the China factor out, the world is?There are 3.7 million tons of inventory outside of China.

What is this concept?Look at the inventory consumption ratio.

This is a global inventories, except China is at its highest level since 2003, second only to the highest level in 2011, that is to say the global cotton or too don't match between supply and demand, supply pressure is very big.

What is the increase in the consistency of the world's leading cotton producing countries?3.1 million tons, this year the good crop weather, and all cotton acreage in rose, this is a basic concept, is the global inventory pressure, sales is very big, so also creates ICE recently for a period of time has been wandering up and down in 70, the lowest reached 66, when he lift the plate, because the pressure is too big.

So what's the decision of this big plate?It is the future that will be in a weak internal and strong pattern.Why is it weak?

China is a lack of the yield of cotton was insufficient, and foreign production, two if comprehensive roughly balanced, but now China is the stage to inventory, national cotton reserves continued to inventory, so in terms of policy, it will continue, can't say it's completely open to the import of cotton, in this case must be weak in the strong outside a basic pattern, the behind, we will have much impact the market?

1, inventory

First we want to see the inventory, inventory, according to Chinese cotton information net monthly summary of China's cotton business inventory data, or read Chinese cotton industry inventory statistics, can very clearly see that the end of August, China cotton business inventories is a total of 1.01 million tons, industrial inventory is 710000, business inventories rose by 500000 tons from last year.

In addition, in September, we postponed the amount of the storage to 56,600 tons, and the amount of storage in September is also to be calculated in this cotton annual supply. What kind of concept is this?With a total of 2.28 million tons, which is more than 500,000 tons over the same period last year, what is the concept of 228 tons?It's basically three months.

What does that mean in more than three months?A recent period of national cotton reserves sales and sales of the crop is parallel, on the one hand, the crop concentrated a large number of listed, short time of periodic pressure, on the other hand has just come out in the national cotton reserves continue into the order of the supply, internal direct competition with the crop.

So while there is a 3 million metric ton gap this year, there is still a lot of pressure to focus on supply.

2, consumption

We say that there is a lot of pressure on the supply, and can that be a good way to relieve the pressure?Now, in general, consumption is good.In terms of consumption, the good news is more.

This is xinjiang to the mainland of the traffic volume and the cotton yarn import situation, the traffic volume is smaller and smaller, what reason?The cotton has remained on the border.Cotton imports in 2016 purple this wire, it did not appear like high growth in 2014, the year is negative, actually our textile overall consumption is growing, but there is no growth, import yarn and show?The amount of cotton imported from us has been replaced by domestic cotton, which has been replaced by the cotton reserves, which is also a good factor to promote domestic cotton consumption.

3, spreads

But just say so many good final fundamental prerequisite must maintain a reasonable price difference inside and outside, for now, spread to the entire Chinese cotton market operation, now spread reached 3000, is the domestic cotton prices higher than international market of nearly 3000 dollars, 3000 is the textile can't afford a state, our yarn, yarn domestic foreign yarn price reduction, with the comparison of varieties, for a long time is negative.

Basically three to eight months of this year, are negative, but now is positive, is now more than 400, that is our price competitive advantage in the gradually losing, cotton price difference too much, in particular, has gone beyond the affordability of the enterprise, then why do we say now in the market reflect so many questions, because many companies still use domestic cotton in the market, still use national cotton reserves, still use the old stock, the new cotton has no real into the circulation enterprises, not really into the circulation, there is no real used by a lot, so I think the effect will gradually enlarge in December, or induction in mid to late November begins.

4. Current price difference

And the other is the price difference, what's the problem that we're going to focus on?In fact, we were more confused in August and September, and now we have a clearer concept.Last year, zheng cotton gave many opportunities for arbitrage and arbitrage, which I think is difficult to meet in these years.It is the earliest time to 17000, the opportunity is too good it's hard to meet, because last year warehouse registration is problematic, warehouse registration is not match with actual transaction, of course, this year's actual holdings is also low, the warehouse receipt to register is also low, this year is another a kind of state, so relatively speaking, the problem is that there is no designated delivery warehouse registrations in xinjiang.

Warehouse volume is very low, because now is not suitable for the warehouse receipt, the price is too inappropriate, but there is a problem, I think if we want to have to note that this does not match the relationship is going to be broken, because I said just now there is gap between spot and futures, the gap between contradiction must return, is the futures return spot, away from the spot, or lean toward futures, spot, is worth considering.

Futures will gradually upgrade depend, I personally think that certain markets will give some chance, can't be run in a state of off forever, that is, if at some point, such as 1801 to delivery, even there is a 1805, now there is no arbitrage price relationship between 1801 and 1805, but not in the future, no, I think about this arbitrage.

But I don't think it's a normal situation, so if you're going to do cotton, I want you to look at this.

5. ICE pricing

of course, that's when it comes to the international market, affect a future market factors, such as pricing of ICE, ICE depends on two fundamental factors of pricing, a whole export the United States each year, and one is India.America is now one of the biggest positive, although overall, the ICE area is weak, but the United States export contract is very good, its export contract are currently has reached 60% of the annual plan, and its five-year average is 45%, has been far more than the five-year average, what it means, its pressure is not so big.

6. Indian cotton pricing

India is determined by its listing of the crop, can compete with American cotton pose a direct, we see in history, direct competition with the United States has a lot of time, but the last two years is a piece of peace.In the past two years, India has been making some uncertain things.

India and China, it has collection and storage, it is a seed cotton purchase, purchase price has been rising, recently for a period of time and he is also put forward a S - 6 state of gujarat in is higher than in previous years has risen again on the purchase price of 500 dollars, why?India is now in the general election, and wants to buy the bill, so he added another 500 yuan, so that would directly lead to a big rally in the market in the first two days of ICE.

India's cotton high support, in the case of support, as long as not particularly big impact in the international market in India, not particularly large pressure on the us cotton exports, ICE plate don't go too deep.I think the negative pressure in India this year is not so big, which also caused the ICE to fall not deep, which will not put a lot of pressure on zheng cotton, which is my judgment.

7. Policy and economics

Cotton uncertainty of macroeconomic regulation and control policy can't get to forecast, the biggest uncertainty is China after two years in a row of round out, from the stock under the condition of the step down, will be a very good price this year certain rounds into the situation, there are all kinds of market speculation, will turn into, frank would have to say, I didn't hear any information on that, just now is policy research stage, as to what will be, who also said that bad, but from what we give some Suggestions on the government, this year is really a very good chance, may be in the next few years may not have such a good chance.

So everyone's expectations, this not only domestic, international market also has, so it is also a form to the international market price support very big factor, is the psychological factors, it is because we believed that the Chinese government will not sit back national cotton reserves continuously falling inventories regardless, so we all think that under this beautiful expectations are supporting the prices, actually if it's purely from the market, this price no matter from domestic or international, a bit on the high side.

Another is China's monetary policy, monetary policy mainly is the issue of RMB exchange rate, RMB exchange rate in the first half is the appreciation of the euro against the dollar, but in the second half of this year, many economists analysis is of the RMB exchange rate to the continued appreciation against the dollar situation will change, of course it is subject to the us dollar.

Is the sino-us trade remains a problem, I think for cotton, will not cause the cotton quota has some change, this is just some speculation of the individual, there is no current evidence that but sure I will stick to it, a trade war and the biggest brand is the commodity trade war between the blocks of compromise, goods import and export of a compromise, cotton originally had this precedent, that behind will do some to raise quotas, make some compromise, to follow developments to see change, at least is uncertainty.

And the table, causing a global monetary tightening, anyway to put it bluntly, this is not a time of global easing, whole is an era of austerity, tight liquidity flooding, but not in China, the international market in developed countries, emerging economies are a monetary tightening state, so the liquidity, I think there is no real is a problem, may be its negative influence, it is more and more big images will be concentrated onto the second quarter of next year.

China's domestic cotton balance sheet in 2017

Let me show you our balance sheet. Why did I put the balance sheet at the end?Because I based on the judgment of the various factors, and our business inventories, business inventories, comprehensive, we obtained a is so we think this year's basic supply and demand of the whole cotton, output is 5.4 million tons, from this, xinjiang 4.61 million tons, 14% higher than the same period last year, China is 780000 tons, 20% more than a year ago, this is China's cotton is 5.4 million tons.

Total demand, I haven't adjusted now, why not adjust?Because I felt at the back of the variable is very big, textile is good now, next year will be good, next year's macro economic factors will pose a larger pressure, to industry would increment of continuity measures now?

This data, in fact, I personally think that next year's aggregate demand are likely to 8.5 million tons, or more, will also have certain growth on the basis of this year, but growth will slow, in such a case, what is a gap between them?The shortfall is close to 3 million tons and 3 million tons. If we are to import it, there is a possibility of 2 million tons of reserves.

What are we going to do in this way?Calculate when we march may also be stored, such as our wheel, the wheels in, these are closely linked, through the balance sheet to calculate some detailed account, so the corresponding, the next year or a cautious preference of a state, after all, where Chinese demand, China's stock is not in reducing, a drop in demand in China did not appear obvious, there is a gap in China, so I still want to emphasize a weak strong such a pattern, make the following on from the pattern of the judgment, the judgment, actually I'm standing in the Angle of the spot to go up and said, if as a transaction, you can actually go for flexible use.

Four, summary

First of all, the first half of the year, that is to say, the Spring Festival next year, before the Spring Festival, the cotton market before the Spring Festival, the domestic cotton market is expected to maintain the overall pattern of the weak internal strength.

Second, the domestic market short-term pressure, I said just now, the supply is concentrated in the volumes, middle market opportunity will be multiplied, later period depends on tomorrow there are many possible policy variables, the influence of the economic environment, there are a lot of market opportunities, market opportunity of the trim deviations.

Third, increased difficulties of the operation of the market, on the premise of policy unchanged, the price range narrowed, it actually gives many sets of treasure chance last year, price points, but this year, it is clear that the disk can't up to now, disk is very weak, not particularly concern a variety, indeed, because this year's market is not conducive to the futures of this operation.

Fourth, the time of the long - run time of the futures is longer, and the opportunity of the transaction may increase.

These judgments are actually I am made in early September, and I followed a period of time, so found basically did not change, my judgment is basically were fulfilled, the futures premium for now have to find the opportunity, to find again.

Fifth, holding resources at the same time, the means of obvious risks increase, this is for our spot business, especially in southern xinjiang cotton, southern xinjiang cotton quality is poor, the price is high, big risk.

Sixth, long-staple cotton market, if you do spot, can pay attention to, cotton vice weakness is expected to continue, perhaps if doing bean, oil can be found that cotton vice follow those, there will be no special big change, from this perspective, I hope you if you want to make a deal, now is really need a dormant, but the future for a period of time first to see whether the 1801 have the possibility of a soft squeeze, premise is open up, and a gap is 15, 15 spread behind I think have a chance, may have a lot of uncertainty in it, maybe will give some good market opportunities.